- 10 min to read

6 Best Online Payment Service Providers for Jamstack Websites

Payment service providers are some of the most important pieces of technology today. And in 2020, there are so many powerful options that it can be paralyzing to choose one.

While we are yet to understand the COVID-19 effect on shopping behavior in general, one thing is certain: retail eCommerce websites have undergone an unprecedented global traffic increase during these troubled times, already surpassing holiday season traffic peaks. Businesses shifted their selling/promotion activities to the web, just as consumers’ habits moved more to web purchases.

One of the crucial parts in the new business model, invisible to most but hugely important to all, are payment service providers.

With this in mind, I wanted to outline the best online payment service providers for Jamstack websites (since we are Jamstack oriented web dev shop and all).

But first, let’s kick off with the basics and see what exactly payment service providers are and why they are so important.

What are payment service providers?

Payment service providers (PSP) connect merchants, consumers, card brand networks, and financial institutions. They make it possible for businesses to accept payments through a single channel and handle the transaction from the beginning to the end. From the moment a user adds their card details to the moment the funds appear in the merchant's bank account.

The main reasons that merchants choose to work with payment service providers in the first place are:

- cost-effectiveness ie the fees are much less compared to having an individual payment type

- and the ability to handle several different payment methods such as credit and debit cards, traditional bank transfers, online banking transfers, etc. from one platform.

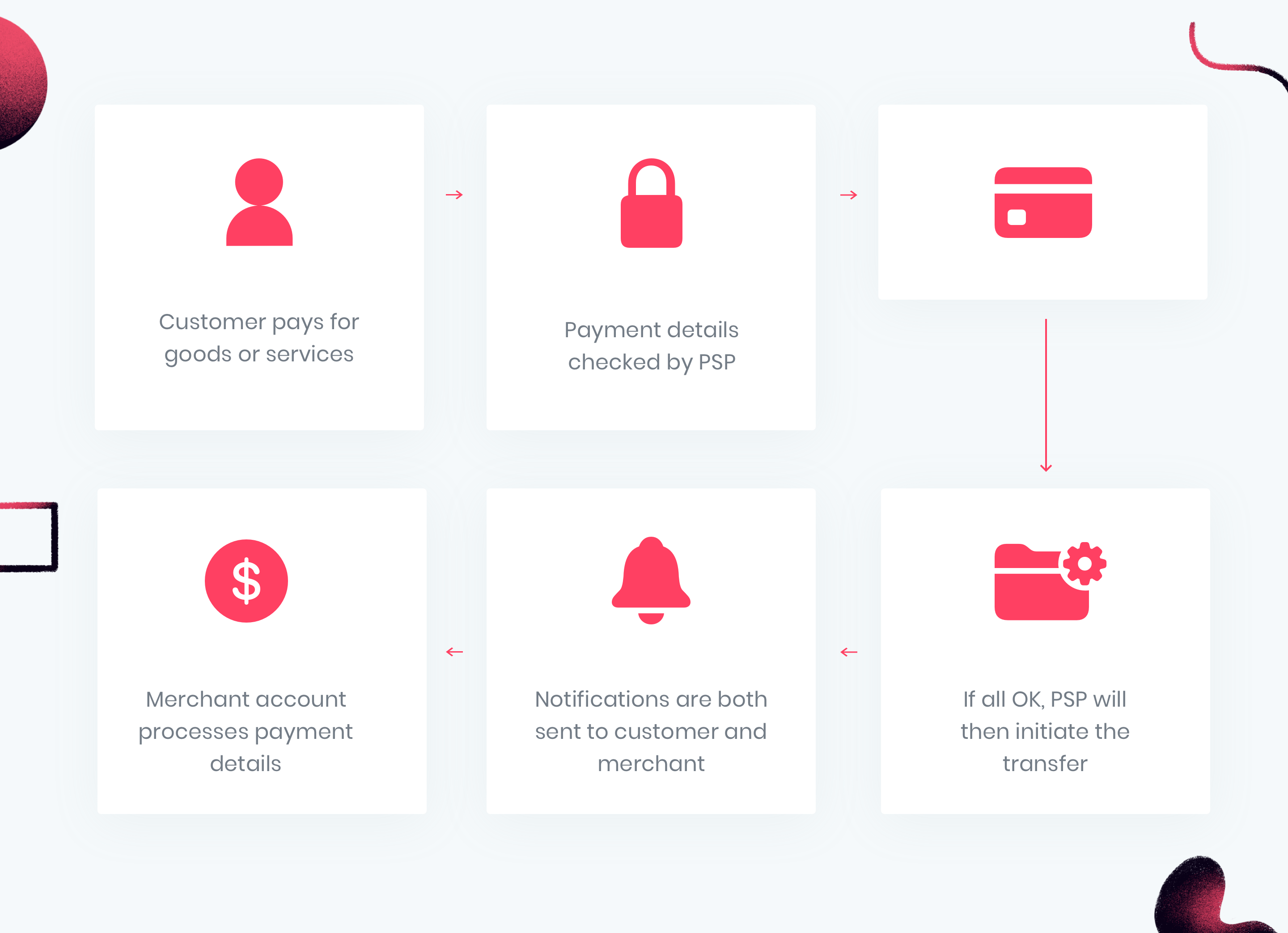

How do payment service providers work?

Payment systems typically consist of three major participants. These are a merchant, a dealer, and a processor (a payment distributor or gateway). A processor exists to authenticate payment info and transfer it between banks and third-party groups. They are provided by financial institutions and are available 24/7.

Here’s how the whole process would look in detail for most transactions.

- After a customer adds his/her bank card number and finalizes pay, this request gets sent to the payment service provider

- The PSP does a check of the customer's card and if the card has available funds to make the purchase. This is done with the help of a payment processor.

- If everything goes well, the PSP will then initiate the transfer from the customer's bank account to the merchant account

- And lastly, the PSP will send a notification to both a customer and a merchant that the payment was completed successfully

If something goes wrong, like adding a wrong card number or in the case of insufficient funds on the card, the PSP will end the process and notify a customer and the merchant of the failed payment.

OK, now we got the basics out of our way, let’s review some of the best online payment service providers for Jamstack websites.

Top online payment service providers for Jamstack websites

Nowadays, there’s plenty of choices when it comes to online payment service providers. Almost everyone has heard of PayPal and Stripe but there are other providers too. Keep reading.

Stripe

Stripe is one of the most popular payment processors in the world. It's known as a full-stack payment processor which means that it serves as both a third-party payment processor and a payment gateway. Stripe allows businesses to process both credit and debit cards, but also automated clearing house (ACH) transactions.

Some of the biggest brands in the world, such as Lyft, Pinterest, Under Armour, Slack, Shopify, and Booking use Stripe. The service can handle 135 currencies and that's why it's the most common choice for many businesses in the world.

Stripe is extremely easy to set up and authorize for use. Adding a new business takes a few minutes and the revenue streams are very well organized. Another great thing about Stripe is its numerous integrations with different platforms, especially eCommerce ones and with accounting software.

The Radar feature can block most fraudulent payments and there’s also a possibility to add your own fraudulent transaction detection rules. However, there have been instances when Stripe’s Radar feature caused false positives during detection. In that case, users need to email their support to ask for assistance. The customer service has been rated as top-notch and you can expect an answer within 48 hours for most complaints or questions.

Better customization may also require in-depth technical skills or developer resources so that’s something you should take into consideration.

Here’s a quick overview of Stripe’s pros and cons;

Pros of using Stripe

- Flat, predictable rates

- Great international presence

- Extremely easy to set up

- Integrations with third-party tools

- Radar fraudulent detection tool

Cons of using Stripe

- False positives in Radar fraudulent detection can occur

- Technical skills are necessary for better customization

What about Stripe and Jamstack?

You can get started with Stripe checkout on Jamstack sites easily too. Here’s a full documentation guide. Netlify has another great guide that you can check out here. Their Jamstack approach works with any static site generator.

PayPal

PayPal is one of the biggest names in the fintech world for well over a decade. It lets users pay and shop online using a secure internet account. You can add your bank account or debit/credit card details seamlessly and start using PayPal in a matter of minutes.

PayPal doesn't only exist to be connected to your bank account details. You can also receive money through the service, issue invoices, transfer money to other PayPal users, etc. They also offer a free business account, just like the Personal one.

PayPal is widely established and most retailers accept payments made through it online. Service offers a buyer protection guarantee which will ensure that you get refunded in case an item you bought online doesn't arrive or doesn't match a seller's description.

It comes with a strong encryption feature that protects both user’s and merchant’s data.

There are some drawbacks to using PayPal. The use of PayPal comes with significant charges, especially for their business accounts where they take 2.9% percent for receiving money on goods and services. Also, being one of the most popular payment options makes PayPal one of the prime targets for phishing and scams.

Another thing to note is that PayPal can freeze your account in some instances, especially if your business gets too many complaints from customers. That’s one more incentive to keep your customers happy.

Here’s a quick overview of PayPal’s pros and cons;

Pros of using PayPal

- Easy to use

- Widely established and used worldwide

- Buyer’s protection policy

- Integrations with third-party tools

Cons of using PayPal

- Fees

- Accounts being frozen and terminated

What about PayPal and Jamstack?

The simplest use case is the use of the PayPal button. With it, you'll be able to set up 'add to cart' buttons. Once you click it, PayPal will take care of the rest and send you an order confirmation email. Basically, you’ll get a cart management system and inventory management besides payment service.

If you need something more complex like having a custom UI for the cart or allowing users to download a file after the payment is done, writing a serverless function is possible via order API. In this case, the cart management would be in JS, and the payment processing would pass information to the lambda function.

Chargebee

Chargebee is an ideal cloud solution for businesses that rely on a subscription model. The service offers a few pricing models such as recurring, one-time, and usage-based billing.

Other features include the ability to change pricing, provide discounts, run promotions, invoice generation, payments collection, and more. All this without the need to hire a developer. These services are delivered on the web via the cloud.

In case you’re wondering whether Chargebee will work with your revenue management stack it probably will! The service has integrations with tools such as Xero, Sage, PayPal, Stripe, Pipedrive, and Salesforce.

Chargebee also offers great API documentation and actionable data through reports and notifications.

When it comes to downsides, I have to mention that mobile interfaces are not fully optimized. Their email automation is very robust. It’s a little bit difficult to customize triggers by subscription service, so you need to send one message to all subscribers for a specific action.

Another very important thing to take into consideration is Chargebee’s pricing plans. They are quite expensive compared to Stripe for example, which offers a similar set of tools for free or a cheaper price.

Chargebee starts at $299 per month but there’s a free trial available.

Here’s a quick overview of Chargebee’s pros and cons;

Pros of using Chargebee

- Automates all your billing processes

- 25+ payment getaways

- Syncs with accounting software

- Smarter subscription management

Cons of using Chargebee

- The user interface could be better

- Expensive plans with no room for flexibility

What about Chargebee and Jamstack?

Chargebee can be integrated with Jamstack sites and their API documentation can be found here.

Recurly

Recurly is another subscription commerce platform used by big brands such as AccuWeather, Asana, PipeDrive, Lucid Chart, and Unbounce.

Just like Chargebee, it lets you set up recurring payments and take care of billing management.

Where Recurly really excels is in the area of credit card transactions by helping correct over 60 common errors that could happen. The service significantly contributes to better customer retention by cutting credit card declines by nearly 30 percent.

Recurly offers integrations with third-party tools and has a user-friendly platform. No training is required to use their service. Their customer service is really great and the site has a knowledge database with plenty of helpful posts.

They could do better with invoice customization and analytics dashboard. The analytics section is useful but limited in options. Just like Chargebee, Recurly could work on offering more competitive rates.

There are three pricing packages with the cheapest one starting at $99 a month. A free trial is available.

Here’s a quick overview of Recurly’s pros and cons;

Pros of using Recurly

- Corrects most common credit card transaction errors

- User-friendly platform

- Third-party integrations

Cons of using Recurly

- Reports could be more advanced

- Expensive plans

What about Recurly and Jamstack?

Recurly will expect you to take care of the front-end interfaces but they will handle all the back-end stuff for charging your subscribers. With that said a dev at hand is a must to implement it.

Trolley

Trolley is perhaps one of the simplest payment platforms on the market. Head to the official site to try their demo and see for yourself! You can get paid in a matter of minutes and with a few options - from your website, in person, or via a link.

Whether it’s physical products, downloads, direct deposits, or subscriptions, Trolley can handle them all.

The integration is simple. The trolley will give you an HTML button that you can paste onto your site or send a link to someone in order to get paid.

The best thing about Trolley is that it can work with any kind of website - from WordPress to static site generators such as Netlify and Contentful.

There are no setup costs. The trolley takes 2 percent per transaction including your Stripe fees. A great thing is that you can also cancel anytime and you won’t have to pay any penalties.

The trolley doesn’t offer ACH check transactions, POS transactions, receipt printing, and gift card management. Also, you’ll need a Stripe account to use Trolley.

Here’s a quick overview of Trolley’s pros and cons;

Pros of using Trolley

- Simple to set up

- Payments via the website, link, or in-person

- Works with different kinds of websites

- No setup costs, cancel anytime

Cons of using Trolley

- A Stripe account is needed

- Fixed rates

- No POS transactions, gift card management, and receipt printing

What about Trolley and Jamstack?

Trolley is a JavaScript-driven, pop-up shopping cart and payments solution that's designed from the ground up to work with static sites. Take a look at how easy it is to set it up on your Jamstack website.

Braintree

Braintree is a big competitor to Stripe run by PayPal. What makes it unique is that it is the only platform that offers PayPal integration, Venmo, credit and debit cards, Apple Pay, and Google Pay. The service is used by many brands including Uber, Dropbox, Yelp, and Github.

With this service, you can build custom integrations using Braintree’s API or get started immediately with v.zero, which is a UI for customers that lack development knowledge.

Braintree offers comprehensive payment type support, multi-currency options, great subscription, and marketplace tools.

The pricing policy is quite simple as well. Braintree charges 2.9% + $0.30 per transaction. And for the most part, there are no additional surcharges or fees.

In the beginning, it might take a while before your account is approved as Braintree asks for extensive documentation in some cases. There have been instances of held funds and closed accounts so this needs to be taken into consideration before choosing Braintree as your main payment provider.

Here’s a quick overview of Braintree’s pros and cons;

Pros of using Braintree

- Venmo integration

- Multi-currency options

- Simple pricing policy

- Apple and Google Pay support

Cons of using Braintree

- Held funds and closed accounts occurrences

- The approval process can take a while

What about Braintree and Jamstack?

Braintree has full API documentation so you can create a checkout button for your eCommerce store easily.

Takeaway

It is no easy task choosing a payment service provider. But, you can say that when choosing a 3rd party API to handle certain functionality or the basic stack as well.

Every project requires a certain level of customization unique to it. The best you can do is make damn sure you understand the specifics of each PSP and your project needs before making a decision.

Or opt-out for a web dev shop that can help you connect the dots and make them work. Like Bejamas of course.

Have a project at hand and you need help? Let’s talk.